Antheil Maslow & MacMinn, LLP (AMM Law) Family Law attorney Melanie J. Wender was appointed to the Pennsylvania Bar Association’s Family Law Section Council at the July 11th Summer meeting held at the Hyatt Regency Chesapeake in Cambridge, Md.

As a member of the PBA family law section council, Wender will be involved in the development and practical working of the law relating to marriage, divorce, support, custody, property, economic matters, and domestic relations generally, as well as laws relating to adoption and juvenile dependency.

Melanie Wender is a dedicated and supportive advocate for individuals and families facing the sensitive issues involved in family law matters. Ms. Wender focuses her practice exclusively in all aspects of divorce and family law. She is also experienced in adoption issues and has assisted many clients in making this life-changing process as seamless and smooth as possible, allowing the family to focus on welcoming their new child.

To learn more about Melanie Wender, you can view her attorney profile here. To learn more about Family Law services at AMM Law, visit the webpage at ammlaw.com

Antheil Maslow & MacMinn, LLP is a full-service law firm located in Doylestown, PA. At AMM, we pride ourselves on developing deep relationships with our clients by taking time to understand their goals in order to provide responsive, practical legal advice and aggressive advocacy.

Antheil Maslow & MacMinn, LLP, (AMM Law) is proud to announce that Gabriel T. Montemuro has been selected to the Pennsylvania Bar Association’s Leadership Institute Class of 2024-25. According to the Pennsylvania Bar Association’s website, “The criteria for application is a demonstration of leadership ability in some capacity, a willingness to make the time commitment to the ten-month program and age 40 years or younger or have practiced five years or less.”

The Bar Leadership Institute (BLI) participants will learn about the day-to-day operations, governance, resources, and staffing of the Bar Association, and will be introduced to the various leadership opportunities within the Bar.

Commenting on his selection, Gabe responded, “I am honored to have been selected for the Pennsylvania Bar Association’s Bar Leadership Institute Class of 2024-2025. I look forward to working with my colleagues from across the Commonwealth to maintain integrity and excellence in the practice of law.”

Gabe Montemuro, focuses primarily on civil litigation, representing clients in contract claims, commercial litigation, real estate disputes, and a broad range of other civil matters. Gabe also works with insurance companies and underwriters on complex coverage determinations.

To learn more about Gabriel Montemuro, you can view his attorney profile here. To learn more about litigation services at AMM Law, visit AMM Law's Litigation page.

Antheil Maslow & MacMinn, LLP is a full-service law firm located in Doylestown, PA. At AMM, we pride ourselves on developing deep relationships with our clients by taking time to understand their goals in order to provide responsive, practical legal advice and aggressive advocacy.

Antheil Maslow & MacMinn, LLP, (AMM Law) is pleased to announce that Adam M. Weiss has joined our Business & Finance practice group. Adam focuses his practice on business and corporate law, serving as a valued partner to owners and key leadership of closely held businesses in a variety of commercial and real estate transactions. With experience across the full range of business owners’ legal needs, Adam provides his clients with strategic advice to reduce risk and meet their goals throughout the life cycle of the business. Adam advises businesses on all aspects of corporate and commercial transactions including formation, mergers and acquisitions, financing, joint ventures, commercial agreements, real estate transactions, and business succession planning.

Antheil Maslow & MacMinn, LLP is a full-service law firm located in Doylestown, PA. At AMM, we pride ourselves on developing deep relationships with our clients by taking time to understand their goals in order to provide responsive, practical legal advice and aggressive advocacy.

To learn more about Adam Weiss, visit his attorney profile at ammlaw.com. Visit AMM Law's Business & Finance page for a full description of legal services.

FTC Non-Compete Rule: Legal Challenges Complicate the Compliance Timeline

Written by Patricia Collins

Reprinted with permission from the June 8th edition of The Legal Intelligencer. (c) 2024 ALM Media Properties. Further duplication without permission is prohibited.

On April 23, 2023, the Federal Trade Commission (“FTC”) issued a final rule imposing a broad restrictions on non-competition agreements (“Final Rule”). The Final Rule requires employers to rescind existing non-compete agreements, and preempts conflicting state laws. The Final Rule is effective on September 4, 2024. In the meantime, there were three cases filed (one of which has been dismissed) that may result in a stay of implementation of the rule. This creates uncertainty for employers and employees in preparing for the effective date of the Final Rule. The Final Rule dramatically impacts both employers and employees. Employees subject to these agreements, and contemplating a move, may be waiting for September 4, 2024 to make decisions. Employers must prepare to determine to whom they will send rescission notices, and what steps they will take to ensure protection of trade secrets and customer relationships.

The Final Rule defines “non-compete clauses” as follows: any agreement that prevents a worker from, or penalizes a worker for, seeking or attempting to seek employment with any employer after the termination of their current employment. The Final Rule mandates that it is a prohibited unfair method of competition to enter into or “attempt to enter into” a non-compete clause with an employee, or to enforce an existing non-compete agreement, or to represent to an employee that they are subject to a non-compete without a good faith basis to believe they are.

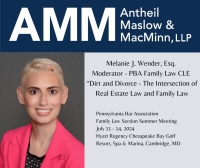

AMM Family Law attorney Melanie J. Wender will serve as Moderator of program entitled “Dirt and Divorce – The Intersection of Real Estate Law and Family Law. This continuing legal education workshop will occur at 10:15 a.m. – 11:45 a.m. on Friday, July 12th. The presentation explores the various issues practitioners and courts need to consider when dealing with real estate in divorce matters. The panel will present the perspectives of a seasoned judge, expert broker and practitioner as they address the complexities, pitfalls and best practices involved in addressing real estate issues in the context of equitable distribution and support including, but not limited to, issues involving the marital residence, investment properties, commercial properties, refinancing, assumptions and other property ownership interests. Wender moderates the program which includes Speakers: Hon. James M. McMaster, Bucks County Court of Common Pleas; Catherine A. Curcio, Esq.; Ken Feinman, Cross Country Mortgage.

The workshop is offered as a part of the Pennsylvania Bar Association Family Law Section Summer Meeting hosted from July 11 – 14, 2024 at Hyatt Regency Chesapeake Bay Golf Resort, Spa & Marina, Cambridge, MD. To access the brochure and register, visit 2024FamilyLawSummerMeeting.pdf (pabar.org)

Melanie Wender is a dedicated and supportive advocate for individuals and families facing the sensitive issues involved in family law matters. Ms. Wender focuses her practice exclusively in all aspects of divorce and family law. She is also experienced in adoption issues and has assisted many clients in making this life-changing process as seamless and smooth as possible, allowing the family to focus on welcoming their new child.

Associate

215-230-7500, ext. 133

aweiss@ammlaw.com

Practice Groups

- Business & Finance

Education

- Rutgers School of Law, Juris Doctor,2020

- Lehigh University, Bachelor of Science, cum laude (Finance)

- Lehigh University, Bachelor of Arts, cum laude (International Relations)

Bar Admissions

- Pennsylvania

Antheil Maslow & MacMinn, LLP is proud to announce that ten of our attorneys have been selected for inclusion again this year in the 2024 Thomson Reuters Super Lawyers and Rising Stars listing. Each year, no more than 5 percent of the lawyers in the state are selected by Super Lawyers to receive this honor. Super Lawyers, a Thomson Reuters business, is a rating service of outstanding lawyers from more than 70 practice areas who have attained a high degree of peer recognition and professional achievement.

Six Partners of the firm were selected to the 2024 Super Lawyers List: Jessica A. Pritchard, Family Law, who was also selected for the Top 50: 2024 Women Pennsylvania Super Lawyers List; Elizabeth Fineman, Family Law; Michael W. Mills, Estate & Probate; Joanne M. Murray, Business/Corporate Law; and Peter J. Smith, Business/Corporate Law; Melanie Wender, Family Law.

Four AMM attorneys were selected to the 2023 Pennsylvania Rising Stars list: Lisa Bothwell, Business/Corporate Law; Jennifer Dickerson, Family Law, Megan Weiler, Family Law and Partner Elaine Yandrisevits, Estate & Probate.

Antheil Maslow & MacMinn, LLP is a full-service law firm located in Doylestown, PA. At AMM, we pride ourselves on developing deep relationships with our clients by taking time to understand their goals to provide responsive, practical legal advice and aggressive advocacy.

AMM partner and business attorney Peter J. Smith attended American Lawyer Media's 2024 Pennsylvania Legal Awards Celebration at the Loew's Hotel in Philadelphia on May 15, 2024. Peter was named one of six finalists for ALM’s 2024 “Most Effective Deal Maker” Award, together with distinguished business attorneys from Dechert, Cozen, Jones Day, Reed Smith and Troutman Pepper. ALM’s Pennsylvania Legal Awards are peer nominated and identify attorneys across the state whose commitment to excellence and dedication to their clients distinguishes them within the legal community.

The Most Effective Deal Maker Award recognizes outstanding legal acumen in the complex world of mergers and acquisitions, and other business transactions. When asked what one piece of advice he would offer to M&A attorneys, Peter replied, “Treat every client like they’re family. Business lawyers often get lost in the complexities of the practice of law and lose sight of the human element of what we do. M&A is a complicated and foreign process for many clients. It is an extremely stressful and emotional time. I try to never lose sight of this. I ask myself “How would I approach this situation if this client were my brother/sister/child?”

Peter has a broad transactional practice focusing on mergers and acquisitions, corporate law, business transactions, private placements, contracts, real estate, commercial finance, business disputes, non-profit organizations, and trusts and estates. He counsels start-up ventures, family-owned businesses, limited liability companies and 501(c)(3) public charities. He also represents individuals and families in estate and business succession planning.

Antheil Maslow & MacMinn, LLP is a full-service law firm located in Doylestown, Pennsylvania. At AMM, we pride ourselves on developing deep, long-lasting relationships with our clients by taking the time to understand their goals in order to provide responsive, practical legal advice and aggressive advocacy.

Visit our Business & Finance page to learn about AMM corporate attorneys and services. To learn more about Peter J. Smith, visit his attorney profile.

AMM business attorneys Peter J. Smith & Lisa A. Bothwell will present at the Bucks County Bar Association’s 6th Annual Business Law Institute on Tuesday May 7th. The program, “Sell-Side M&A /Purchase Agreements,” will be offered at 11:00 AM – 12:00 PM at the BCBA building, 135 E. State St., Doylestown, Pa. All courses are available in-person or via Zoom. Register today at Bucksbar.org/calendar.

Peter Smith is a Partner with Antheil Maslow & MacMinn, LLP. His practice focuses on corporate law, business transactions, mergers and acquisitions, private placements, contracts, commercial finance, debtor/creditor relations, business disputes, non-profit organizations, real estate, and trusts and estates. He counsels businesses involved in manufacturing, distribution, marketing, retail, e-commerce, technology, health care, pharmaceutical research, consulting, professional services, real estate and construction. In addition, Peter has experience with start-up ventures, family-owned businesses, limited liability companies and 501(c)(3) public charities. He also represents individuals and families in estate and business succession planning.

Lisa Bothwell helps her corporate clients implement strategies and find creative solutions during all stages of owning a business. She advises corporate clients on a broad range of matters, including mergers and acquisitions, joint ventures, capital raising events, business separations, and corporate governance.

The federal Corporate Transparency Act (the “Act”), requiring many businesses to report beneficial ownership information about their owners and anyone with substantial control of the company, went into effect on January 1, 2024. This means that any “reporting company” in existence prior to January 1, 2024 has until January 1, 2025 to report; any reporting company that was formed on or after January 1, 2024 but before January 1, 2025 has 90 days after formation to report; and any reporting company formed on or after January 1, 2025 has 30 days after formation to report.

How to File a Beneficial Ownership Information Report (BOIR)

- Is your company exempt from reporting?

- Are you tax-exempt? If so, you do not need to file a BOIR.

- Do you have more than 20 full-time employees in the U.S., a physical office in the U.S., and gross sales or receipts over $5,000,000 from U.S. operations? If so, you do not need to file a BOIR.

- Check here for other exemptions.

- If your company is not exempt, you must file a BOIR.

- Use our BOIR checklist here to gather the information and documents that are required for the BOIR before you go to the BOIR portal.

- Go to the BOIR portal: https://boiefiling.fincen.gov/. You can file the report one of two ways:

- You can use Adobe Acrobat Reader to prepare the report in PDF format. This allows you to save and go back and make changes before filing.

- File online. The online option does not need Adobe Acrobat Reader, however, you cannot save and go back and make changes

- Enter information or click on each action tab and fill out information.

- Finalize and submit form; certify form.

- Once submitted you will get progress bar which will let you if rejected or successful.

- Once Submission Status Confirmation is displayed, select Download Transcript to download PDF copy which will serve as your receipt of submission.

There is no annual reporting requirement. Reporting companies must file an initial BOI report and updated or corrected BOI reports as needed.