When there are two or more equity holders, a Buy-Sell Agreement is a powerful tool to help control a company’s future. Contractually determining what happens to the company stock after a triggering event (termination of employment, disability, death, third party offers) can avoid shareholder disputes and can also solve some of the owners’ estate planning problems. While no single, sure-fire method of determining the price exists, having a well thought out formula and contractual obligation to regularly update the valuation of the stock price is essential.

NON-PROFIT FORMATION

Forming a non-profit organization involves several steps.

- Choice of entity advice

- Obtaining tax-exempt status & compliance advice

- Development of required governing documents such as:

- Articles of Incorporation,

- Certificate of Formation

- Bylaws.

- Governance Advice regarding Board of Directors/Trustees and Organization Meeting

- Employer Identification Number (EIN)

ENTITY CHOICE

There are many forms to choose from such as:

- C Corporation

- S Corporation

- Limited Liability Company (LLC)

- General Partnership, Limited Partnership (LP), Limited Liability Partnership (LLPs)

- Professional Corporation

- Business Trusts

JOINT VENTURES & STRATEGIC ALLIANCES

Individuals and entities may enter into joint ventures and strategic alliances for a variety of business reasons; for example:

- Pooling resources for research and development of a prototype

- Joint manufacture of an existing product

- Shared distribution channels in the marketing or distribution of products

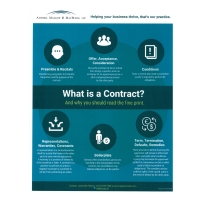

Contract drafting and review services include:

- Developing new contracts

- Property and lease agreements

- Reviewing existing contracts and enforcing your rights with regard to employment, vendors and customers

Succession Planning Services Include:

• Evaluation of the business to assess its profitability, financial health, business objectives and

prospective successors;

• Assessment of alternative transition structures to maximize tax and cash flow objectives for

both existing and projected leadership/ownership;

• Assistance to owners in obtaining valuation information in order to draft equitable buy/sell

and similar valid succession agreements;

• Development of estate planning documents which provide for ownership transfers;

• Identification of possible conflicts and issues when not every family member is involved in the

business, and coordination of the discussion and resolution of issues that may arise during

transition;

• Facilitation of conflict resolution procedures in relation to future management of the

business.

The federal Corporate Transparency Act (the “Act”), requiring many businesses to report beneficial ownership information about their owners and anyone with substantial control of the company, went into effect on January 1, 2024. This means that any “reporting company” in existence prior to January 1, 2024 has until January 1, 2025 to report; any reporting company that was formed on or after January 1, 2024 but before January 1, 2025 has 90 days after formation to report; and any reporting company formed on or after January 1, 2025 has 30 days after formation to report.

How to File a Beneficial Ownership Information Report (BOIR)

- Is your company exempt from reporting?

- Are you tax-exempt? If so, you do not need to file a BOIR.

- Do you have more than 20 full-time employees in the U.S., a physical office in the U.S., and gross sales or receipts over $5,000,000 from U.S. operations? If so, you do not need to file a BOIR.

- Check here for other exemptions.

- If your company is not exempt, you must file a BOIR.

- Use our BOIR checklist here to gather the information and documents that are required for the BOIR before you go to the BOIR portal.

- Go to the BOIR portal: https://boiefiling.fincen.gov/. You can file the report one of two ways:

- You can use Adobe Acrobat Reader to prepare the report in PDF format. This allows you to save and go back and make changes before filing.

- File online. The online option does not need Adobe Acrobat Reader, however, you cannot save and go back and make changes

- Enter information or click on each action tab and fill out information.

- Finalize and submit form; certify form.

- Once submitted you will get progress bar which will let you if rejected or successful.

- Once Submission Status Confirmation is displayed, select Download Transcript to download PDF copy which will serve as your receipt of submission.

There is no annual reporting requirement. Reporting companies must file an initial BOI report and updated or corrected BOI reports as needed.